Orders with Multi-Gateway Payment Options

Accepting payments should be easy for both your customers and your team. That’s why we’ve introduced a powerful update to your online ordering system: you can now enable PayPal, Stripe, and Sage Pay at the same time. Not to mention the addition of SumUp Payments.

This new feature gives your customers more choice at checkout and helps you reduce failed transactions, improve cash flow, and deliver a more professional ordering experience with your preferred payment gateways.

Why Offering Multiple Payment Options Matters

In today’s fast-paced world, customers expect convenience. Whether they’re ordering on-the-go from their mobile phone, laptop, or tablet, they want a seamless checkout experience, without jumping through hoops to pay.

For takeaway and restaurant businesses, this translates into a few key advantages:

More completed orders: Less friction at checkout means fewer abandoned carts.

Greater trust: Customers feel more comfortable when they see familiar, trusted payment options.

Reduced reliance on a single provider: If one gateway experiences downtime, others remain active.

Potentially lower payment gateway fees in the future: There may be potential to negotiate payment fees on your behalf (later this year).

Accepting multiple payment methods isn’t just a nice-to-have. it’s a strategic advantage for growing your business online.

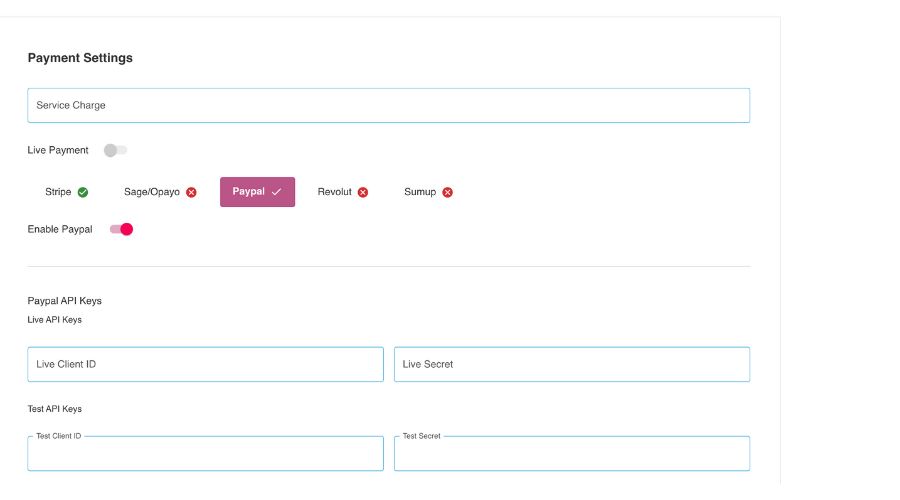

What's New in the Payment Settings?

With this update, you can now run PayPal, Stripe, and Sage Pay side by side. Previously, you could only enable one payment provider at a time. Now, your checkout can offer all three simultaneously, allowing customers to choose their preferred method at their convenience.

Additional improvements include:

- – A more robust PayPal integration, reducing delays and errors

- – A cleaner, more intuitive payment settings panel in your admin dashboard

- – Compatibility with future payment methods, making the platform more flexible over time

How to Enable Payment Gateways

Activating payment gateways is simple and can be done in just a few minutes:

1. Log in to your store’s admin dashboard.

2. Go to Settings > Payments.

4. Click into each provider (PayPal, Stripe, Sage Pay) and connect your account.

5. Enable the providers you wish to offer at checkout.

6. Save your changes.

From that point on, customers will see all available payment options during the checkout process.

Key Benefits for Your Business

By using multiple payment gateways, your takeaway can:

Capture more sales by catering to customer preferences

- – Minimise failed payments due to gateway-specific issues

- – Increase efficiency with smoother payment processing and fewer support requests

- – Boost customer confidence with trusted, branded payment options

For customers, the difference is a faster, smoother, and more reliable ordering experience. For you, it’s better conversion rates and fewer operational headaches.

Which payment gateway should I choose?

Stripe

Best for: Fast card payments, modern digital-first takeaways, transparent fees

Stripe is one of the most widely used online payment processors and is known for its clean interface, fast payouts, and competitive pricing. It’s ideal for takeaways that want to offer card payments without friction.

Key Benefits:

- – Accepts all major debit and credit cards (Visa, Mastercard, Amex, etc.)

- – Easy to set up with a business bank account

- – Transparent, competitive fees (typically ~1.5% + 0.25c)

- – Payouts to your bank every 2–3 business days

- – Supports Apple Pay and Google Pay

Good to know:

- – Requires business verification before going live

- – No PayPal or wallet-style functionality

Recommended for: Businesses prioritising card payments, fast access to funds, and clear reporting.

PayPal

Best for: Customer trust, quick purchases, mobile users

PayPal is a well-known and trusted brand -many customers already have a PayPal account and prefer using it for online purchases because of its buyer protection and convenience.

Key Benefits:

- – Instant name recognition—boosts trust at checkout

- – Customers can log in and pay without entering card details

- – No need to share card data with the merchant

- – Integrated support for Pay in 3 (instalments)

Good to know:

- – lightly higher transaction fees than Stripe (often ~2.9% + 30p per transaction)

- – Payouts must be transferred manually (unless auto-withdrawal is enabled)

- – Some customers may not use PayPal at all—so it shouldn’t be your only option

Recommended for: Takeaways with a high number of mobile or repeat customers who value speed and flexibility.

Sage Pay (Opayo)

Best for: Businesses using legacy systems or those that want a secure, all-in-one solution

Sage Pay (now known as Opayo) is a long-standing payment provider popular with businesses that require a more traditional setup or want to integrate with existing back-office systems (e.g. Sage accounting software).

Key Benefits:

- – Strong security features and fraud prevention

- – Suitable for high-volume businesses needing detailed reporting

- – Offers virtual terminals and in-store payment solutions

- – UK-based support and compliance with local regulations

Good to know:

- – Setup is slightly more complex and may require approval

- – Not as widely recognised as PayPal or Stripe with end users

- – Monthly fees or gateway charges may apply depending on your plan

Recommended for: Established businesses already using Sage tools or those looking for a more structured, accountancy-friendly solution.

How to Set Up a Payment Gateway Account (Step-by-Step)

Include brief, tailored setup guides for each provider with external links. Example:

Setting up Stripe:

- – Visit stripe.com and click Start Now.

- – Provide your business name, email, and banking details.

- – Verify your identity (passport or driving licence).

- – Connect your account through our dashboard.

Setting up PayPal:

- – Visit paypal.com/business and select Get Started.

- – Choose PayPal Business Account.

- – Enter your business information and link a bank account.

- – Approve integration within your admin dashboard.

Setting up PayPal:

- – Visit opayo.co.uk and register for an account.

- – Provide merchant account details and processing volume estimates.

- – Once approved, enter your

- – Vendor Name and credentials in your admin panel.

What Information You’ll Need to Set Up Each Gateway

- – Business name and address

- – Bank account details

- – Tax or VAT number

- – Valid ID for identity verification

- – Website or store link

Final Thoughts

This update is designed to help takeaway and restaurant owners deliver a more flexible and reliable online ordering experience. Whether you’re just starting out or looking to grow your digital presence, enabling multiple payment gateways is a simple step that delivers a better experience for your customers.

We’re committed to continuously improving our platform based on feedback from businesses like yours. If you’d like help setting up your payment gateways our support team is here to assist.

Stay tuned for our next update, where we’ll be exploring new analytics tools designed to help you monitor performance and make smarter business decisions.